The information contained in this article is not intended as legal advice and may no longer be accurate due to changes in the law. Consult NHMA's legal services or your municipal attorney.

Municipal officials are often asked to explain to constituents the mystery around unreserved fund balance. Questions abound surrounding this complex topic, especially during the development of the budget and the annual meeting process. To assist the electorate in understanding unreserved fund balance, this article will explain the function of fund balance in government while keeping the citizen perspective in mind.

The average constituent might think of fund balance within the context of a regular checking account, but governmental finances do not operate like personal spending accounts. The term “fund balance” is one that is frequently used in governmental financial reporting to indicate a positive or negative change to a municipality’s fiscal position; however, a fund balance is not the same thing as keeping cash in a checking account.

What is Fund Balance?

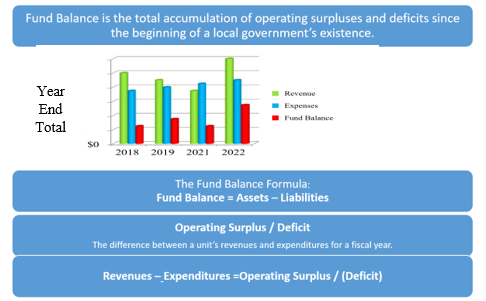

In government accounting, fund balance is the difference between assets and liabilities resulting in a surplus or a deficit. A common misconception is that fund balance is a cash account, associated with or correlated to a government’s bank account balance. But unlike a personal bank account, a general fund balance is not a “cash-account;” it is a measure of equity between revenues and expenditures. Government fund accounting is unique to the public sector (i.e. cities, towns, schools) and requires separate self-balancing accounting entries to track each fund’s revenues and expenditures. In the private sector it would be defined as a company’s working capital, but in public sector, it is referred to as fund balance. In government finance, the retention and use of unassigned fund balance assists in measuring the financial health of an individual fund, such as the general fund.

Why isn’t all fund balance returned to the taxpayers at year end by using it to lower the tax rate?

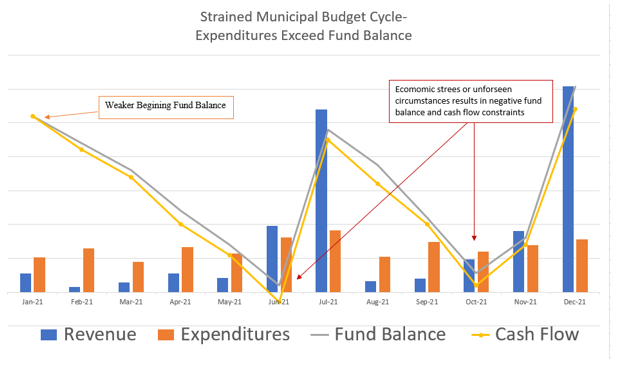

Fund balance is sometimes misunderstood and criticized as an unnecessary accumulation of money that could be used to lower taxes and fees. A municipality’s ability to use unassigned fund balance can be seen as a driving factor behind maintaining stable tax rates. As a financial tool, the main objective of establishing and maintaining fund balance reserves is to create a strong fiscal position that will allow a local government to weather negative economic trends and unforeseen circumstances. Essentially, maintaining the appropriate level of fund balance will mitigate current and future risk and to ensure a stable cash flow.

What is the relationship between the annual budget, fund balance and cash flow?

Budgets serve a different purpose in a government than they do in a private sector business. In a business, the budget is a plan to shoot for—often an aggressive plan that a business may or may not be likely to achieve. In the public sector, a local government creates a comprehensive plan to provide a desired level of services defined by local priorities through the budget process. In other words, a local government budget is a statement of policy and values.

In a government, the expenditure side of the budget is called “appropriations,” and it is the legal authority for the governing body to provide a given level of service granted by the legislative body. The revenue side is the income a local government needs to pay for all of the services it provides. The major sources of revenue for a municipality include taxes, service charges, and fees. These revenue sources help a municipality gain financial stability, broaden the tax base, and expand the types of activities and services available; they are also largely independent of state and federal funds. Most municipalities depend on revenues collected during a single period, despite having consistent, year-round expenses.

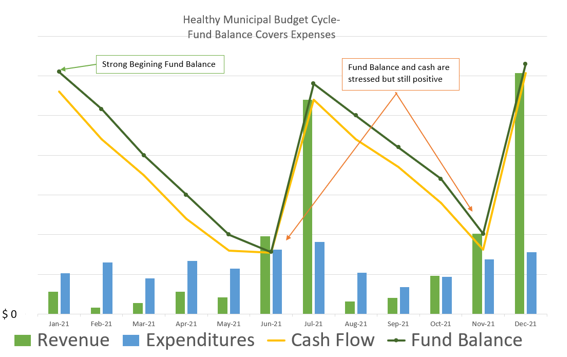

Adequate fund balance allows local officials to maintain a stable set of public services throughout an entire budget cycle because a typical municipal cash flow cycle will have cash on hand amounts decreasing as the June and December tax collection approach. Unlike a business, municipalities do not have the ability to raise additional revenues during the fiscal year. A local government relies on drawing down existing fund balance (excess capital) to ensure adequate cash on hand is available to meet expenses before collections arrive.

Understanding that the natural revenue cycle within a local government is directly tied to fund balance reserves allows for the prudent management of financial resources throughout the year. When cash flow is under stress, a municipality may issue short term debt to cover the gap, requiring an interest cost to maintain steady operations and introducing risk. Adequate fund balance negates that need, saving resources that would otherwise be spent on servicing the cost of that debt. A strong fund balance will allow the municipality to meet cash flow needs, complete scheduled projects, and provide a contingency in the case of an emergency or disruption in revenues. Fund balance also has credit rating implications. According to the published local government rating methodology from Moody’s Investors Service, “a fund balance between 15% and 30% of revenues is needed to receive a scorecard value of “Aa.” This supports the importance of each municipality adopting a policy that reflects a strong fund balance approach to meet both short-term and long-term financial goals.

How much fund balance should a local government retain?

There is no single answer to this question, as each municipality should analyze its own unique circumstances to determine the appropriate level of fund balance to retain. Some concepts and best practices to consider have been developed by the Government Finance Officer’s Association (GFOA).

Let’s begin by stating that zero is not an advisable option. Every government entity requires some level of fund balance for cash flow purposes and for responses to emergencies. There is an appropriate range of fund balance because it is possible to have too little, but it is also possible to have too much. Key factors to consider when establishing an appropriate level of unreserved fund balance include:

- Considering a policy that targets an amount equal to two months of operating expenses, including debt service obligations.

- Generally, the GFOA recommends a range of 5% to 15%, regardless of the size of the municipality.

- The New Hampshire Department of Revenue Administration (DRA) recommends 5%-17%. The higher percentage takes into account that New Hampshire is one of the most heavily reliant states on property tax as revenue for the operation cities, towns, schools, and counties.

Determining and maintaining appropriate fund balance levels requires regular analysis and monitoring. In light of economic trends, risk tolerance, or emergencies that impact a municipality, levels of unassigned fund balance may need to be adjusted as a budget grows and new debt service obligations are issued. Some elements to consider might be a historical review of the timing of how revenues are received, and expenditures are paid. Also consider the impact of revenue and expenditure patterns on cash flow and peak cash flow needs over most recent years. Determine available cash for emergencies during peak cash flow needs and perform an assessment of the municipality’s risks which could occur simultaneous with peak cash flow needs.

Closing Thoughts

There are several different subcategories when it comes to fund balance, and this article focuses on the unassigned fund balance, which are available reserve funds that can be used or spent in the upcoming budget year. The governing body may appropriate any amount of the undesignated fund balance in excess of the designated retained percentage to offset property taxes as part of the final adopted budget for a fiscal year. In addition, excess funds may also be used for capital improvement projects, equipment replacement, and other similar budgetary needs, but these actions may require legislative body approval.

A policy should be developed which clearly states when fund balance reserves will be used, how they should be used, how the reserves will be replenished (and how quickly), and what happens when fund balance or reserves drop below the designated levels. Defining these conditions and triggers will help minimize misinterpretations associated with the use of fund balance.

In conclusion, defining fund balance uses and limits for your municipality within the scope of a policy ensures a balance exists between collecting more taxes than are necessary while still allowing for the prudent accumulation of funds. A municipality will be well served by maintaining a reasonable fund balance. This financial tool will help to bridge cash flow, avoid interest costs from short-term borrowing, preserve credit ratings, and provide a buffer against revenue shortfalls or expenditure overruns.

Katherine Heck is the Government Finance Officer for the New Hampshire Municipal Association. Katherine can be reached by telephone at 603.224.7447 or via email at kheck@nhmunicipal.org.

Resources:

- “Rating Methodology: US Local Government General Obligation Debt,” Moody’s Investors September 27, 2019. p.13.

- “Fund Balance Guidelines for the General Fund” Government Finance Officers www.gfoa.org/ fund-balance-guidelines-general-fund