The information contained in this article is not intended as legal advice and may no longer be accurate due to changes in the law. Consult NHMA's legal services or your municipal attorney.

Community Choice Aggregation (CCA) has emerged as a powerful tool for New Hampshire municipalities to take control of their energy futures. With over 40 active towns participating through the Community Power Coalition of New Hampshire, Standard Power, Colonial Power Group or Freedom Energy Logistics, the landscape is growing—but so is the need for strategic evolution.

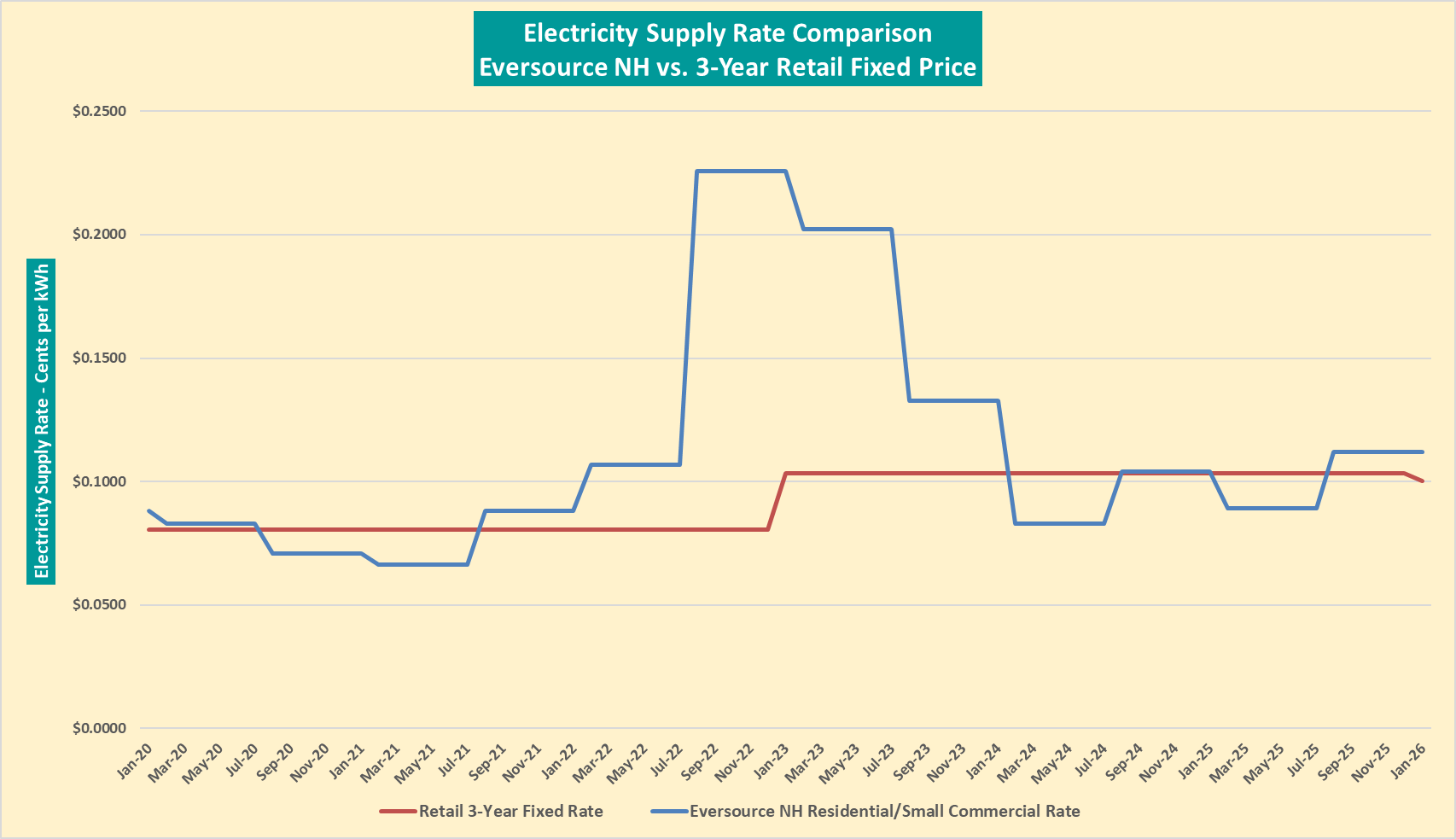

One area ripe for reconsideration is contract duration. Most CCAs in New Hampshire follow the utility’s cadence of six-month supply contracts. This approach was originally designed to ensure rates stayed below utility default service, a cautious strategy that worked for a time. But since January 2025, many, if not all, of the communities on this cycle have seen this strategy backfire with rates well above default service.

This article is not intended to dissuade use of short-term contracts; they have their utility. It is about encouraging towns to think differently, more strategically, about how they use and optimize their CCA programs to deliver long-term value and stability to their residents.

The Problem with Short-Term Thinking

Electricity markets are volatile. From 2021 to 2022 New England went from historic lows to historic highs in under 18 months. Prices can swing dramatically due to weather, fuel supply disruptions, and global energy policy shifts. For ratepayers, especially seniors and low-to-moderate income households, these fluctuations can be difficult to absorb.

Short-term contracts, while flexible, often miss opportunities to lock in favorable rates. They also expose communities to the same volatility as utility default service and traditional residential third-party supply. When prices spike, everyone feels it. There is no cushion, no fallback.

Longer-term contracts, on the other hand, offer budget certainty. They smooth out the bumps and allow towns to plan with confidence. And when appropriately timed, they can deliver savings and stability—a rare combination in today’s energy landscape.

Hampton and Salem Lead the Way

Take Hampton, for example. Their first CCA contract was an 18-month term at just over 9 cents per kWh, currently the lowest aggregation rate in New Hampshire. They were conservative on duration, as many towns are with their first contract. But seeing the benefits, they have now locked in a three-year agreement at 11 cents per kWh.

With natural gas trading around $3 per dekatherm (dth), a key driver of electricity prices in New England, this is more than likely to be an excellent entry point. Hampton’s residents will enjoy three years of price certainty at a time when volatility is the norm.

Salem, one of the fastest-growing communities in the state, followed suit this Fall with a two-year agreement, also around 11 cents per kWh. With Liberty Utilities’ rates climbing to 12.4 cents and potentially higher in February, Salem can now market its energy program as a quality-of-life benefit: great neighborhoods, good shopping, excellent restaurants—and stable, affordable energy rates!

Massachusetts: A Model of Long-Term Success? In this case, YES.

While we do not often look to our neighbors to the south for examples of what we should do, Massachusetts has over 150 active aggregations, and the majority opt for longer-term contracts between 1 and 3 years. The results speak for themselves.

A 2023 survey by UMass Amherst[1] found that 79% of Massachusetts CCAs achieved savings versus utility default service. While savings were the top priority, 60% of respondents cited price stability as a key motivation for launching their programs.

This is a stark contrast to New Hampshire, where only a small fraction of CCAs have gone beyond six-month terms. Is it any surprise then the NH’s savings track record is also in stark contrast to Massachusetts? If price stability is a core goal, then longer durations should be part of the strategy, and the savings will likely follow.

Why Now Is a Good Time to ‘Go Long’

Looking at the current futures market, the case for longer-term contracts is compelling:

- Electricity futures for 2026 have dropped from 6.8 cents to 6.4 cents per kWh.[2]

- 2027 and 2028 futures are even lower, at 5.3 and 4.9 cents, respectively.[3]

- Natural gas futures, which heavily influence electricity prices, have declined from $4.47 to $3.85 per dth.[4]

- Storage levels are healthy, sitting between the five-year average and maximum.[5]

- ISO New England predicts annual electricity consumption will increase by 11% over the next decade, if we do not keep up with generation this burden will manifest in higher prices.[6]

This suggests a favorable buying environment. Locking in now could protect communities from future spikes driven by geopolitical tensions, weather events, or supply constraints.

Longer-term contracts do not mean towns lose flexibility. The beauty of CCA is that it allows for strategic migration between the default offer and the aggregation. What manufacturer would not love to have the option to come and go from a long-term energy contract without penalty? If the market shifts, rate payers can adjust. But having a stable base rate gives them leverage—and options.

In short, CCAs should be used not just for savings, but for budget certainty. That is the real value. And it is especially important for vulnerable populations who cannot afford surprises in their utility bills.

New Hampshire’s CCA movement is still in the early stage. There’s room to learn, adapt, and improve. One of the most impactful changes towns can make is to rethink contract duration. Longer terms can deliver the dual benefits of savings and stability, helping communities' weather the ups and downs of an unpredictable energy market.

Whether you are a town just launching your CCA or one looking to renew, consider the long game. Your residents will thank you.

[1] https://www.umass.edu/news/article/new-umass-amherst-study-finds-commun…

[2] https://felpower.com/new-england-spot-market-futures-electricity-and-na…

[3] https://felpower.com/new-england-spot-market-futures-electricity-and-natural-gas-price-summary/

[4] https://felpower.com/new-england-spot-market-futures-electricity-and-na…

[5] https://felpower.com/new-england-spot-market-futures-electricity-and-na…

[6] https://www.utilitydive.com/news/iso-new-england-prepares-11-percent-rise-annual-electricity-consumption/747422/