The information contained in this article is not intended as legal advice and may no longer be accurate due to changes in the law. Consult NHMA's legal services or your municipal attorney.

Opportunity rarely knocks twice, but with the passage of the One Big Beautiful Bill Act (OBBBA), New Hampshire’s municipalities have been given a second chance to shape the next decade of investment and revitalization. Opportunity Zones 2.0 is not just a policy update; it’s an invitation for towns and cities to imagine what they could become with the right partners, preparation, and vision.

History

When the original Opportunity Zone (OZ) designations were rolled out in 2018, there was very limited time, data, and coordination capacity to respond. The Governor’s Office was given roughly 90 days to nominate eligible tracts, and the state lacked a pipeline development, fund structuring, or investor engagement. As a result:

- Selection was reactive, based largely on census eligibility rather than project readiness.

- There was no centralized fund or intermediary to aggregate capital or guide investors, other than a landing page on the BEA website.

- Municipalities were not yet organized around promoting or packaging OZ projects.

- The state had few incentives or policy frameworks to attract or retain OZ capital.

In short, New Hampshire identified the zones, but lacked the infrastructure, partnerships, or communication channels to leverage them. The upcoming OZ 2.0 cycle presents a strategic opportunity to correct that and design a coordinated, investable approach. As local leaders head into budget season and prepare for Town Meeting, this moment offers an important question: What future do we want to build, and what do we need to do now to make it possible?

Readiness Is the New Advantage

One of the defining changes in OZ 2.0 is the shift from static designations to a program that refreshes every ten years. For the first time, eligible communities have a predictable opportunity to compete for designation based on their current conditions, not what existed a decade ago.

A village center planning for reinvestment, a former industrial corridor ready for new life, a downtown where rising housing demand outpaces supply, these are the kinds of places now able to make their case. The flexibility gives every region, from the North Country to the Seacoast, a real chance to position itself for the next wave of investment.

But this opportunity is only as powerful as the preparation behind it. Communities that can find the time over the next few months to identify priority sites, summarize their assets, and build relationships with developers will be ahead of when the Governor begins evaluating nominations in early 2026. Many of these actions may require appropriations or warrant articles, making this year’s budget season especially significant.

A Stronger Path for Rural Renewal

Perhaps the most encouraging reform is the creation of the Qualified Rural Opportunity Zone. For rural communities, this is a recognition of what we have long known: reinvestment looks different from urban centers. Smaller projects, older buildings, tighter margins, and more limited local capital have historically made redevelopment difficult.

This new rural zone changes that equation. With a 30% basis boost and a lowered improvement threshold by 50%, projects that once seemed financially out of reach suddenly come into focus. Picture a shuttered mill repurposed into a mixed-use hub, a vacant lot transformed into workforce housing, or an aging downtown block restored into its next chapter; these visions become far more attainable when investor expectations align with rural reality.

But incentives alone don’t create progress. What moves the needle is when leaders can step forward to champion the work: clarifying permitting, engaging property owners, articulating community goals, and ensuring there is a shared understanding of what redevelopment should look like. Rural places have always known how to make the most of limited resources, and OZ 2.0 provides a platform to amplify that strength.

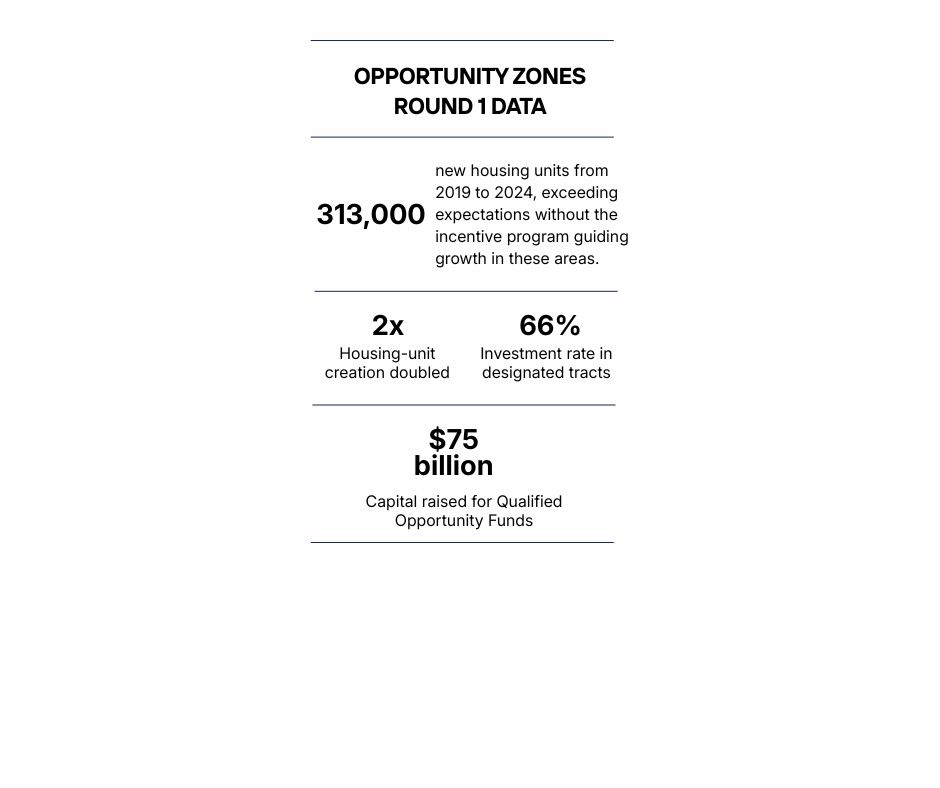

Learning From What Worked

Berlin’s North Country Growers project offers proof of what happens when opportunity and readiness meet. With more than $70 million in OZ investment behind it, and a second phase on the horizon, the project has delivered jobs, grown the tax base, and increased state GDP. Berlin didn’t stumble into success; it set the table for it. It created clarity, aligned stakeholders, and made room for private investment to take root.

Every community in New Hampshire has its own version of a “North Country Growers” waiting to happen. A project that could change the arc of a neighborhood. A downtown parcel with unrealized potential. A municipal property ready for its next chapter. OZ 2.0 is the moment to bring those possibilities to the forefront.

Why This Matters for Local Taxpayers

For many municipalities, the biggest takeaway from OZ 2.0 is not the federal tax benefits, it’s the local fiscal impact. By encouraging private investment in underutilized or blighted properties, OZs can expand the taxable property base without raising rates. Each new housing unit, renovated commercial space, or redeveloped mill adds long-term assessed value, spreading the tax burden across more properties and helping stabilize local tax rates. As communities seek to balance affordability and fiscal health, OZ 2.0 offers a new way to grow the base rather than the rate.

What Municipalities Can Do This Year

The next several months represent an important window, one that aligns directly with budget planning and Town Meeting cycles. Municipalities that begin organizing now will have a meaningful advantage when the state begins its nomination process.

This preparation doesn’t need to be overwhelming. It starts with conversations:

Which properties hold the most potential?

Which owners are open to redevelopment?

Which infrastructure improvements would unlock new investment?

What story do we want to tell the Governor and future investors about our community’s readiness?

From there, communities can build simple but powerful tools, a summary of priority sites, a prospectus outlining local strengths, identifying additional funding sources, and a shared understanding among boards and commissions about goals and timelines. These pieces create clarity. Clarity attracts investors. And investors drive the projects, creating optimal public-private partnerships.

What’s In Progress

Beyond project development and the creation of prospectuses, there is a third critical piece: a structured, compliant investment fund to attract investors and manage capital effectively. To help ensure no community is left behind, efforts have begun to build a statewide Opportunity and Impact Fund: pooling capital, complying with federal regulations, and attracting institutional investors. For municipalities, it means when a project is ready, there would be a place to send it, a partner prepared to evaluate, finance, and support local redevelopment. Creating the needed trifecta for success: readiness, designation, and funding.

A Call to Action

Opportunity Zones 2.0 arrives at a pivotal time. With federal programs shifting, development pressures rising, and local budgets tightening, communities need tools to protect their economic future. This program offers a pathway, not a guarantee, to help strengthen the tax base, attract new partners, and bring projects to life.

The communities that will benefit most are those that act early. Those who take a thoughtful look at their assets. Those who understand the importance of proactive preparation. This is not just about attracting investment. It is about shaping what comes next for New Hampshire’s towns and cities, for their downtowns, their families, their tax bases, and their identity.