The information contained in this article is not intended as legal advice and may no longer be accurate due to changes in the law. Consult NHMA's legal services or your municipal attorney.

One of the challenges in dealing with COVID-19 is understanding the federal funding that is available to help states and local governments respond to public safety concerns and continue providing government services to the citizens of New Hampshire. Complicating the funding discussion is the fact that there are many different “pots” of money, often referred to by different names, that have different spending authorizations, with different eligibility periods, administered by different federal agencies. The following explanation provides a clearer picture of the federal funding for COVID-19, focusing on the funding available to New Hampshire municipalities and the types of expenses generally covered.

Federal Legislation. As of the end of May, there have been four pieces of federal legislation enacted dealing with Coronavirus:

- HR 6074 Coronavirus Preparedness and Response Supplemental Appropriations Act (Enacted 3/6/20)

- HR 6201 Families First Coronavirus Response Act (Enacted 3/18/20)

- HR 748 Coronavirus Aid, Recovery, and Economic Security (CARES) Act (Enacted 3/27/20)

- HR 266 Paycheck Protection Program and Health Care Enhancement Act (Enacted 4/24/20).

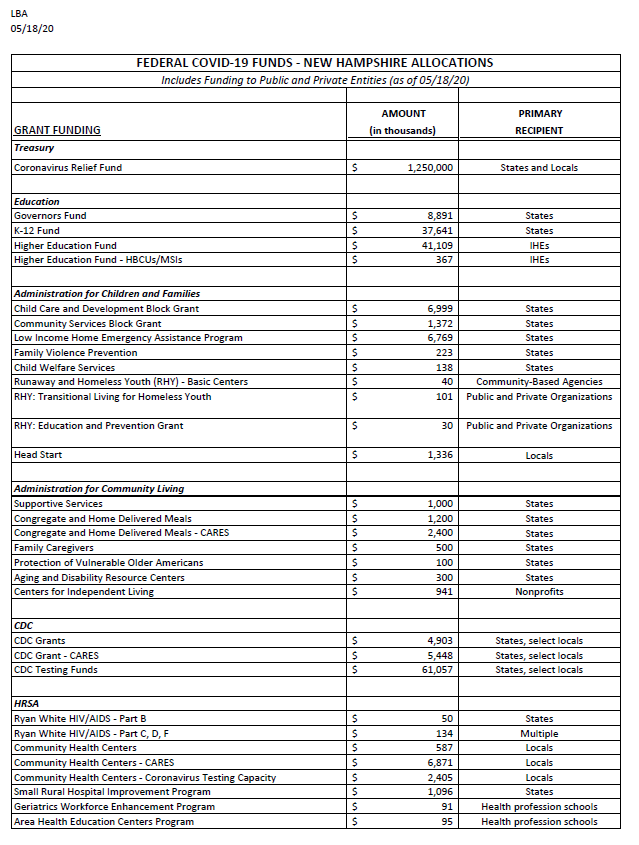

The Legislative Budget Assistant Office (LBA) of the New Hampshire General Court has a Summary of Federal COVID-19 Funds (from all sources) allocated to New Hampshire on their COVID-19 Information page. The summary dated May 18, 2020 totals $1.8 billion in grant funding and $3.6 billion in non-grant funding available to New Hampshire.

None of the federal funding in the four Coronavirus legislative acts listed above provides assistance to state or local governments to compensate for revenue shortfalls from taxes, fees, or revenue-generating operations that have been suspended due to COVID-19 (with one minor exception described below). However, there are discussions in Congress about a fifth funding proposal in which the National League of Cities is advocating for direct funding to municipalities to help address local revenue shortfalls.

Federal Emergency Management Agency (FEMA). What is notably absent from the LBA summary is funding from the Federal Emergency Management Agency (FEMA). Funding for emergency operations and other FEMA-eligible expenses are in addition to the federal funding included in the LBA summary. There is no “grant” allocation for FEMA funding, nor is there a cap on the amount that will be reimbursed to the state and municipalities for FEMA eligible expenses. Typically under FEMA emergency declarations, 75 percent of eligible costs are reimbursed while a 25 percent local match for FEMA eligible expenses must come from non-federal sources, such as municipal appropriations, donations, or volunteer time. However, in the case of the COVID-19 emergency declaration, the CARES Act Coronavirus Relief Fund described below may be used for the 25 percent local match.

Generally, FEMA reimbursement is for emergency protective measures in response to COVID-19, including, for example, personal protective equipment for first responders, costs for emergency operation centers, shelter for vulnerable populations, temporary lodging for first responders needing to isolate, and overtime costs for first responders. Additional information about eligible expenses and the reimbursement process is available on the FEMA Public Assistance Eligibility for COVID-19 website, which includes the Applicant Briefing Slides from an April 24 presentation.

Families First Coronavirus Response Act (FFCRA). While the expanded wage and benefit provisions of this act apply to local governments, the payroll tax credit provision to pay for those additional wages and benefits does not apply. The only form of “funding” to municipalities is a provision exempting municipal employers from having to pay the 6.2 percent Social Security portion of FICA on wages required to be paid under this act. See NHMA Guidance Regarding Employment Taxes Under the Families First Coronavirus Response Act. However, the increased wages and benefits (such as certain childcare costs) required under this act are eligible for reimbursement from the Municipal Relief Fund, explained below.

CARES Act - Coronavirus Relief Fund. Of the four federal bills, the CARES Act received considerable attention due to the amount of funding provided directly to the state for use at the discretion of the governor. New Hampshire received $1.25 billion from the US Treasury for a Coronavirus Relief Fund, the first item listed on the LBA summary, which is sometimes referred to as Flex Funds. The governor created the Governor’s Office for Emergency Relief and Recovery (GOFERR) and established two advisory committees – the Legislative Advisory Committee and the Stakeholders Advisory Committee - to recommend allocations and disbursements of money from the Coronavirus Relief Fund. Information about the work and recommendations of these two Boards is available on the GOFERR website.

Of the seven programs the governor established by May 18 using money from the Coronavirus Relief Fund, two of the programs directly affect municipalities:

Municipal Relief Fund (MRF). In early May the governor allocated $32 million from the $1.25 billion Coronavirus Relief Fund for a municipal relief program. The MRF is a reimbursement program, with each municipality allocated a maximum amount for which reimbursement requests may be submitted to cover COVID-19 related expenses incurred between March 1 and August 31 and not covered by FEMA or another federal program. Additional MRF funding may be provided after August 31.

The MRF may be used for a variety of COVID-19-related expenses, including increased welfare costs, interest on tax anticipation notes, building disinfecting and modifications for social distancing, telework costs for remote municipal operations, payroll costs for increased wages and benefits required under the Families First Coronavirus Response Act, employer payroll taxes associated with First Responder Stipends explained below, the 25 percent match on FEMA eligible costs, and more. However, the MRF may not be used for:

- Costs accounted for in the budget most recently approved as of March 27, 2020;

- Compensating for revenue shortfalls;

- FEMA-eligible expenses;

- COVID-19 expenses covered by other federal programs or grants;

- Workforce bonuses other than hazard pay or overtime;

- Severance pay or legal settlements.

The Town-by-Town allocation of the MRF along with the required grant agreement and reimbursement request form are available on the Municipal & County Payments page of the GOFERR website. Additionally, the MRF Frequently Asked Questions (FAQs) explaining the details of this program is available on the NHMA COVID-19 Resources page.

First Responders COVID-19 Stipend. Also in early May the Governor announced the allocation of $25 million from the Coronavirus Relief Fund for a First Responder Stipend program providing a $300 per week stipend to full-time and a $150 per week stipend to part-time first responders for the period May 4 through June 30. Municipal participation in the program is voluntary, and municipalities may submit the First Responder Stipend Worksheet for the entire 8-week and 2-day period up front, then pay the stipend to eligible first responders weekly, bi-weekly, or in a single lump sum. The stipend is subject to applicable employer and employee payroll taxes, with the employer taxes reimbursable from the MRF. The stipend is included in the calculation of the Fair Labor Standards Act (FLSA) overtime rate but is not considered earnable compensation for New Hampshire Retirement System purposes.

The First Responder COVID-19 Stipend Program and the First Responders COVID-19 Stipend FAQs on the Department of Safety, Division of Homeland Security and Emergency Management (HSEM) website includes detailed information about the program, eligibility criteria, payment instructions and more.

Justice Assistance Grants (JAG). The New Hampshire Department of Justice received $3.4 million under the JAG program of the CARES Act for law enforcement and other first responders to prevent, prepare for, and respond to COVID-19. Funding is available retroactive to January 20, 2020 and will be available for a period of up to two years. As of May 15, $876,000 had been awarded with approximately $2.5 million remaining. Allowable projects and purchases include, but are not limited to, overtime, equipment (including law enforcement and medical personal protective equipment), hiring, supplies (such as gloves, masks, sanitizer), training, travel expenses, and addressing the medical needs of inmates in state and local prisons, jails, and detention centers. Additional information and applications are available on the Department of Justice website.

Provider Relief Funds (Ambulance Funding). In mid-April some municipalities received an unexpected ACH deposit in their bank accounts with the notation “HHS Payment US HHS Stimulus.” This money is listed on the LBA summary as US DHHS Office of Secretary, Provider Relief Funds – General Allocation. The money was paid to healthcare providers that billed Medicare in 2019, making some municipal ambulance services eligible for this funding. Guidelines issued by the U.S. Department of Health and Human Service for use of Provider Relief Funds are different from the guidance issued by the U.S. Treasury for the Coronavirus Relief Fund (and subsequently the MRF). The terms and conditions for the Provider Relief Funds state that the payment will be used only to “prevent, prepare for, and respond to coronavirus, and that the payment shall reimburse the Recipient only for health care related expenses or lost revenues that are attributable to coronavirus.” This is the one exception we have found so far to the general rule that COVID-19 funding cannot be used to compensate for local government revenue shortfalls.

Election Support. The Select Committee on 2020 Emergency Election Support is charged with advising the state on the use and allocation of $3.2 million of CARES Act funding to address the many challenges of holding state and federal elections during a pandemic. NHMA submitted a letter to the committee summarizing the major municipal concerns for the committees’ consideration.

What to Apply for First? COVID-19 funding and reimbursement processes are confusing, and in some cases seem to be a Catch-22 in terms of what to apply for first. Here are a few general recommendations regarding the funding process:

- Apply to FEMA for those expenses you know, or are fairly certain, are FEMA-eligible. Even though FEMA only reimburses 75 percent of eligible costs, there is no cap on the amount FEMA will cover.

- Do not double-dip by seeking reimbursement for the same costs from multiple funding sources.

- Closely track all COVID-19 related expenses and reimbursements, and maintain supporting documentation necessary for audit purposes.

Barbara Reid was Government Finance Advisor with the New Hampshire Municipal Association. Barbara retired from this position in June. Becky Benvenuti has replaced Barbara as Government Finance Advisor and can be reached at 603.224.7447 or at bbenvenuti@nhmunicipal.org.

COVID-19 Funding Article

Reference Sites

LBA Summary of Federal COVID-19 Funds (5/18/20): http://www.gencourt.state.nh.us/lba/Budget/COVID-19_Docs/Federal_COVID_19_Funding_5-18-20.pdf

LBA COVID-19 Information; http://www.gencourt.state.nh.us/lba/COVID_19_Information.aspx

FEMA Public Assistance Eligibility for COVID-19: https://prd.blogs.nh.gov/dos/hsem/?page_id=8237

FEMA Applicant Briefing Slides: https://prd.blogs.nh.gov/dos/hsem/wp-content/uploads/2020/04/Applicant-Briefing-DR-4516-Final-4.25.20.pdf

NHMA Guidance Regarding Employment Taxes Under the Families First Coronavirus Response Act.: https://www.nhmunicipal.org/sites/default/files/uploads/documents/nhma_guidance_regarding_employment_taxes_under_the.pdf

GOFERR Website: https://www.goferr.nh.gov/welcome

GOFERR Municipal & County Payments: https://www.goferr.nh.gov/covid-expenditures/municipal-county-payments

MRF Frequently Asked Questions (FAQs): https://www.nhmunicipal.org/sites/default/files/uploads/partners/nhma_guidance_on_municipal_funding.pdf

NHMA COVID-19 Resources: https://www.nhmunicipal.org/covid-19-resources

First Responder COVID-19 Stipend Program: https://prd.blogs.nh.gov/dos/hsem/?page_id=8466

First Responders COVID-19 Stipend FAQs: https://prd.blogs.nh.gov/dos/hsem/?page_id=8624

Department of Justice Website: https://www.doj.nh.gov/grants-management/funding-availability.htm#covid

Provider Relief Funds: https://www.hhs.gov/sites/default/files/terms-and-conditions-provider-relief-30-b.pdf

U.S. Treasury Guidance for the Coronavirus Relief Fund: https://home.treasury.gov/system/files/136/Coronavirus-Relief-Fund-Guidance-for-State-Territorial-Local-and-Tribal-Governments.pdf

NHMA Letter to Select Committee on 2020 Emergency Election Support: https://www.nhmunicipal.org/sites/default/files/uploads/documents/partners/nhma_letter_5-7-20.pdf