The information contained in this article is not intended as legal advice and may no longer be accurate due to changes in the law. Consult NHMA's legal services or your municipal attorney.

Editor's Note: NHMA would like to recognize and acknowledge the significant foundational contributions of former Government Finance Advisor, Barbara T. Reid, in the development of this important advocacy publication.

State agencies, the governor, and the legislature are beginning New Hampshire’s biennium state budget process for fiscal year 2022-2023 as towns and cities, the state, the nation, and the world continue to battle the unprecedented COVID-19 pandemic. With the extraordinary fiscal impacts now surging due to a second wave of the pandemic, uncertainties loom about budgeted state aid and revenue sharing for municipalities—all the while unbudgeted, yet essential, COVID-related municipal expenses continue to be incurred.

The following are excerpts from NHMA’s recently updated publication: Municipal State Aid and Revenue Sharing: History and Trends. To read the entire publication, which includes additional information and charts, please visit the NHMA website at www.NHmunicipal.org.

Understanding the various types of revenue sharing and aid provided by the state to local governments is critical to understanding the effect that state-level budgetary decisions have on local property taxes. With the property tax as the primary source of local revenue, reductions in any state revenue sharing or aid program, or the shifting of state costs to municipalities, most often result in increased property taxes. This report explains the state revenue sharing and aid programs relied upon by cities and towns as well as recent trends in funding those programs.

Education funding, a major category of state aid, is received directly by school districts, except in the nine cities where the school district operates as a department of the city. Educational funding affects the local school property tax rate, not the municipal tax rate, and is not the focus of this article.

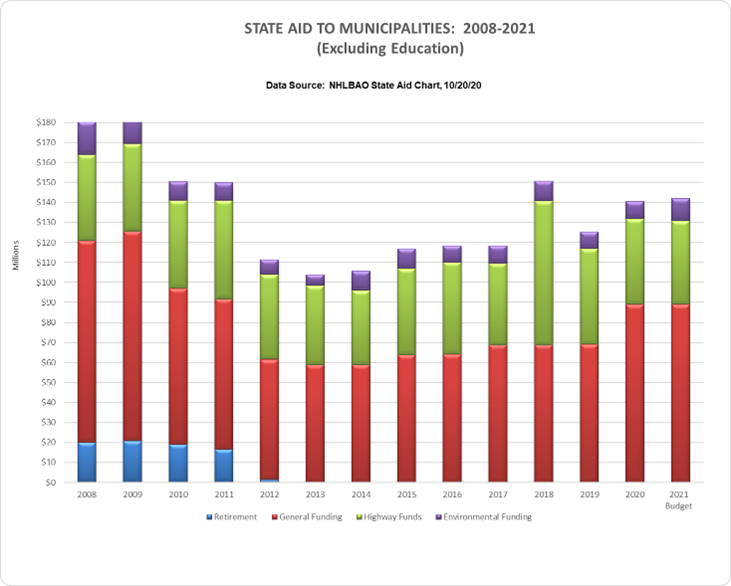

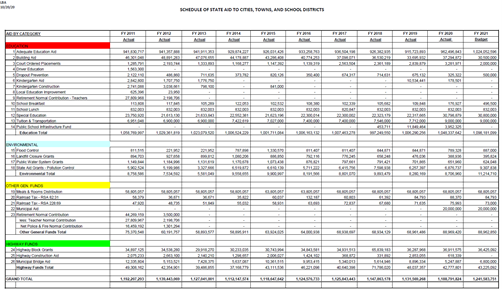

The state aid schedule (Chart A) prepared by the New Hampshire Legislative Budget Assistant’s Office (NHLBAO) shows the three major categories of state aid to cities and towns:

General Funds

Meals and Rooms Tax Revenue Distribution

State Revenue Sharing (Suspended 2010-2021)

State Retirement Normal Contribution (Repealed 2013)

Railroad Tax Distribution (RSA 82:31 and RSA 228:69)

State Municipal Aid Grants (One-Time Surplus: Added 2020-2021)

Environmental

Flood Control

Landfill Closure Grants

Public Water System Grants (Moratorium since 2008)

Pollution Control Grants – State Aid Grants (SAGs)

Water Supply Land Protection Grants

Highway Funds

Highway Block Grants

Highway Construction Aid

Municipal Bridge Aid

The total state revenue sharing and aid distributed to municipalities for years 2008-2021 is illustrated in Chart B. These amounts decreased significantly in 2010-2014 as the state struggled to balance its own budget following the 2008-2009 recession. Use of one-time revenues or surplus in 2018 accounts for the $30 million increase in highway funding. One-time surplus also accounts for the addition of $20 million ‘state municipal aid grants’ in fiscal years 2020 and 2021.

Meals and Rooms Tax Distribution

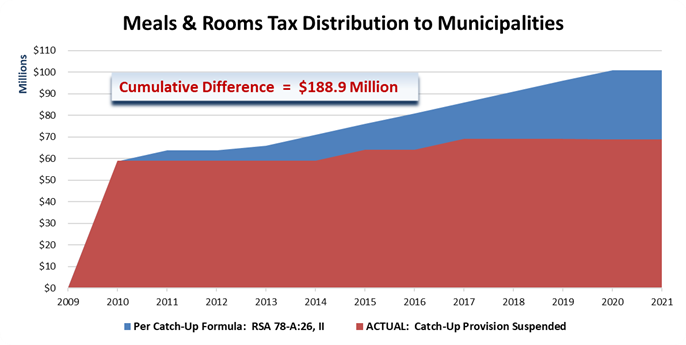

History. When the meals and rooms tax was enacted in 1967, the intent was to share the revenue with municipalities, with the state retaining 60% and municipalities receiving 40% annually. The legislature decreased the municipal share several times (in 1977 and 1981) virtually freezing the funding below the 1976 level. It was not until 1993 that the meals and rooms tax statute was amended to provide an annual catch-up formula to reach the statutory 60/40 split. The formula provides that each year, the amount to be distributed to municipalities equal the previous year’s distribution amount, plus 75% of the year-over-year increase in revenue from the meals and rooms tax, not to exceed $5 million.

The municipal share is distributed to cities and towns based on annual population estimates provided by the New Hampshire Office of Strategic Initiatives. In 1999 the Legislature added rental car receipts to the Meals and “Rental” tax, and 100% of these revenues are paid into the education trust fund.

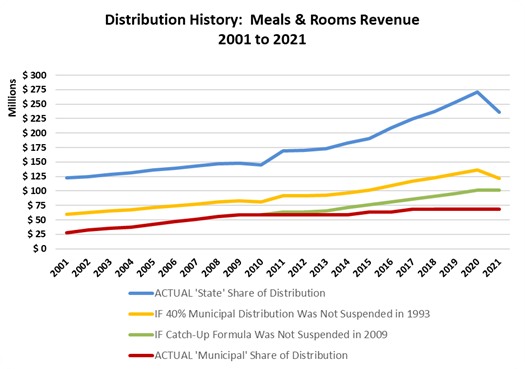

Trends. In 2001, the state/municipal share was 82%/18%. As the meals and rooms tax revenues gradually increased, so did the municipal share of those revenues due to the catch-up formula described above. In fact, in 2010 the state/municipal apportionment reached 71%/29%. However, the catch-up formula was suspended in 10 of the past 12 years, while the tax revenue continued to increase through 2020. As a result, the municipal distribution dropped from the high of 29% in fiscal year 2010 to 20% in fiscal year 2020. Due to the COVID-19 pandemic, the total meals and rooms tax revenue dropped 10.1% in fiscal year 2020. However, the fiscal year 2021 municipal distribution remained level at the 2017, $68.8 million amount, representing a greater, 23% share. (Chart C).

Had the catch-up formula not been suspended for 10 of the past 12 years, the state fiscal year 2021 distribution to cities and towns would have been approximately $101 million, or 33% of the meals and rooms tax revenues received ($305 million unaudited), rather than $68.8 million (23%). Cumulatively, the suspension of the catch-up formula resulted in a loss to municipalities of approximately $189 million from fiscal years 2010-2021 (Chart D).

Revenue Sharing

History. In 1969, reform in how the state taxed businesses led to the implementation of the Business Profits Tax (BPT). This eliminated antiquated taxes which were more reflective of an agricultural economy of the past. These taxes, however, were assessed and collected by municipalities and were part of the property tax base for municipalities, school districts and counties (including tax on stock in trade, taxes on studhorses, poultry, domestic rabbits, fuel pumps/tanks and other taxes). The initial intent of the revenue sharing statute, RSA 31-A, was to “return a certain portion of the general revenues of the state to the cities and towns for their unrestricted use”. Chapter 5, Laws of 1970.

On March 31, 1970, in testimony on House Bill 1, then New Hampshire Attorney General Warren Rudman responded to concerns that future legislators may choose not to honor this commitment to municipalities to fund revenue sharing, stating, “… It seems quite doubtful to me that once this bill is passed that any legislator would go back on its pledge to return revenue to cities and towns that originally belonged to those cities and towns. And I might also add, in passing, that I could hardly see a Governor signing a bill which would deprive cities and towns of the revenue which they once had.”

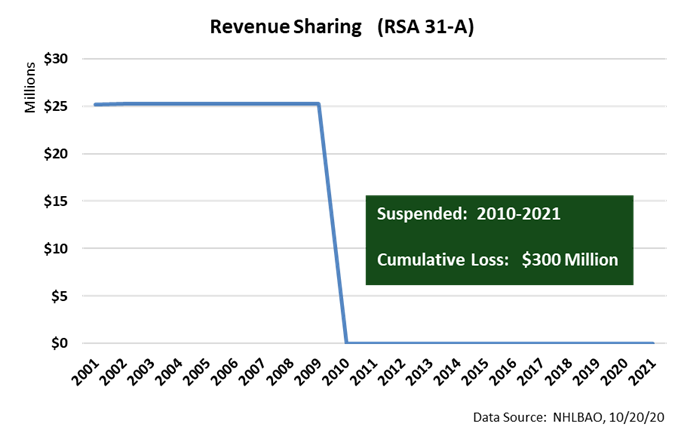

Trends. Total revenue sharing in 1999 was $47 million. In 2000, as part of statutory changes to fund the state’s adequate education obligations, $22 million of revenue sharing that had been allocated to school districts became part of the state adequate education aid funding. This left the balance of $25 million annually as general revenue sharing for municipalities and counties, which remained constant through fiscal year 2009. Since 2010, revenue sharing has been completely suspended resulting in a loss to municipalities and counties of $25 million per year, or $300 million cumulatively from fiscal year 2010-2021 (Chart E). Although clearly not the intended outcome, as Warren Rudman articulated (above), by continuing to suspend this statutory provision, cities and towns are deprived of the revenue they once had before their property tax base was statutorily reduced.

Highway Block Grants

History. Twelve percent (12%) of the total road toll (gas tax) and state motor vehicle fees revenue collected in the preceding state fiscal year are distributed to municipalities through a local highway aid formula. This money comes from the state highway fund, not the state general fund, and provides funding to maintain and improve Class IV and Class V municipal roads and highways. In addition, supplemental funds totaling $400,000 provide assistance to those municipalities who have high roadway mileage and lower property valuations.

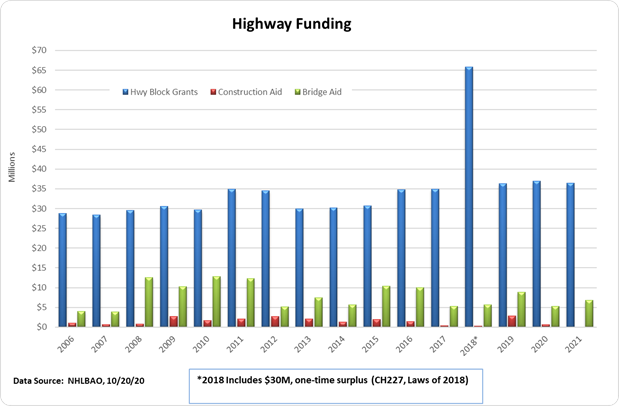

Trends. From fiscal years 2006 through 2010 the total amount of annual highway block grants varied from $28.5 to $30.5 million. In 2009 the legislature enacted a temporary 2-year state motor vehicle registration fee surcharge which increased the state highway fund, resulting in approximately $5 million more for municipalities each year. This highly unpopular surcharge was repealed, and block grant funding to municipalities returned to approximately $30 million per year from 2013 through 2015.

In 2014 the legislature raised the road toll for the first time in 23 years, increasing the rate by approximately 4 cents from 18 to 22 cents per gallon of gasoline effective July 1, 2014. This raised an additional $33 million per year in highway funding of which 12%, or an additional $4 million, has been distributed to municipalities.

Following a principle of “using one-time revenue for one-time expenses,” in 2017 the state appropriated an additional $30 million for municipal highways from general fund surplus. This additional money was apportioned to municipalities based on the same formula as highway block grants and was available for the same municipal highway purposes as the block grants. This additional funding is reflected in fiscal year 2018 and accounts for the significant increase that year (Chart F).

State Bridge Aid

History. The State Bridge Aid program under RSA 234 provides that funding for construction or reconstruction of municipally owned bridges shall be borne 80% by the state and 20% by the municipality, subject to the available level of funding each year. In 2015, 338 (20%) of municipal-owned bridges were classified as “red listed” meaning the bridge was in poor condition, critically deficient and/or functionally obsolete. In 2017 under Senate Bill 38, the definition was modified to be “a bridge with a primary element in poor or worse condition (National Bridge Inventory rating of 4 or less)”. Previously the red list also included bridges with posted weight limits (e.g. “Weight Limit 15 Tons”) regardless of condition. This statutory change resulted in 71 bridges being removed from the municipal red list. As of December 30, 2019, there were 243 municipal red list bridges out of 1,688.

Trends. Historically, State Bridge Aid had been budgeted at approximately $6.8 million annually which resulted in about a 10-year waiting list for state aid. Part of the revenue from the 2014 increase in the road toll discussed above was intended to double the amount of funding appropriated for municipal bridge aid, helping to reduce the 10-year waiting period to a more reasonable timeframe. The increase in State Bridge Aid in fiscal year 2015 reflects funding from the road toll increase which allowed the replacement or repair of more bridges than typically done in a year. However, this was short-lived with the fiscal year 2016-2017 budget appropriations dropping back down to the historic level of $6.8 million per year – with all of the appropriation coming from the 4 cent road toll increase, which was supposed to supplement, not supplant, the bridge aid provided through the highway fund.

In 2016, the state 10-year transportation improvement program was amended to provide an additional $2.5 million in municipal bridge aid for fiscal year 2017. Funding for this additional appropriation came from surplus funds in the Department of Transportation’s winter maintenance budget due to the mild winter. In 2018, an additional $6.8 million* was appropriated for municipal bridge aid, coming from the anticipated June 2017 state general fund surplus similar to the additional highway block grant funding explained above. For 2019 an additional $10.4 million* was appropriated for “high traffic volume” municipal bridge projects. This influx of additional state funding for municipal bridges over the past several years has helped to reduce the waiting period for all municipalities on the list for state bridge aid.

Environmental Grants

History. Municipalities receive grants from the NH Department of Environmental Services (NHDES) for the construction, improvement and expansion of municipal wastewater and public drinking water facilities and also for assistance with the cost of landfill closures. Under these programs, municipalities finance the full cost of the project up-front, complete construction and then apply for payment of the state share, which is 20% to 30% of the eligible project costs, usually paid by the state over the amortization period of the municipal financing (bonding or borrowing from the state revolving loan fund).

State Aid Grants (SAG) – Pollution Control. RSA 486 provides financial assistance in the form of a grant to NH communities to off-set the planning, design and construction costs of certain sewage disposal facilities. The wastewater SAG program provides a 20 to 30 percent grant, depending on the community’s sewer user fee, to NH communities for eligible sewage disposal facilities.

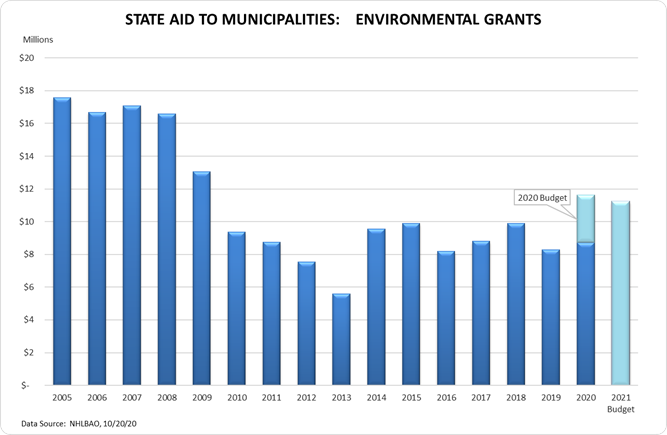

Trends. The amount of state aid grants from the state general fund began declining in 2008 with funding in 2013 less than 32% of the funding in 2005 ($5.6 million vs. $17.6 million). As part of the 2010-2013 budget reductions, the state only funded its obligations for grants approved through 2008. This left municipalities to pick up the anticipated state share ($53 million) for 127 previously approved and completed infrastructure projects - projects which were “sold” to property taxpayers based on financial commitments from the state.

Projects that were approved to receive funding by the Governor and the Executive Council prior to November 2008 continued to receive grant payments. However, State Aid Grant (SAG) pre-applications received after November 2008 were placed on the NHDES “Delayed and Deferred List” and received grants only as funding was restored to the program.

As part of the fiscal year 2014-2015 biennial budget, funding was restored for all projects on this Delayed and Deferred list. With the state making payments of $53 million over the amortization period of

the municipal financing, the net effect on the 2014 and 2015 state budgets compared to 2013 was an increase of approximately $4 million and $4.4 million, respectively. However, also as part of the fiscal year 2014/2015 biennial state budget, a moratorium was placed on funding any new environmental infrastructure projects that did not have local financing authorization by December 31, 2008. In 2016 and 2017 funding was eventually provided for 8 and 19 additional projects, respectively, that had received local financing approval prior to the December 2008 moratorium. This left unfunded, nearly 50 wastewater projects qualifying for state aid of $90 million over the next ten years if the moratorium was lifted.

In 2019, $3,652,347 and $3,781,024 was appropriated for 2020 and 2021, respectively, which match the total fiscal year 2020 and 2021 estimated grant amortization payment amounts reported by NHDES for 70 projects comprising the ‘Current Estimate of Need for Wastewater State Aid Grant Projects’, revised 3/25/19. This list represented all projects expected to have a required substantial completion date of December 31, 2019. As of publication time, all but 6 of the 70 projects have been submitted to Governor & Executive Council and approved for grant payments. Also, 5 additional projects which met the December 31, 2019 substantial completion date have also not been submitted to Governor & Executive Council.

Public Water System Grants. RSA 486-A provides a state contribution to aid public water systems to comply with requirements of the federal Safe Drinking Water Act through two separate programs:

1) Public Water System Grants are equal to 20-30 percent of annual amortization charges (principal and interest) of eligible costs for surface water treatment, regional water systems, and groundwater investigations pay for previously approved projects. The program has not been funded for new projects since 2013. Current budgeted amounts represent grant payments for previously approved projects.

2) Water Supply Land Protection (WSLP) Grant Program, created by the Legislature in 2000, provides municipalities and non-profit water suppliers the opportunity to purchase land or conservation easements. The legislature appropriated $1.5 million per year in the first few years of the program but has not appropriated any funds since 2008. When the program was funded, the average appropriation was $768,521 per year. In 2011, the program received $3 million from a NH Department of Transportation (DOT) mitigation fund associated with the widening of I-93. Under a Memorandum of Understanding (MOU) between NHDES and DOT, the funds are limited to the protection of water supply lands in the communities (Salem, Windham, Derry, Londonderry and Manchester) directly impacted by the I-93 project and land in the watershed of Lake Massabesic, which provides drinking water to the City of Manchester. The final grant was awarded in 2018.

Landfill Closure Grants. RSA 149-M:41-50 authorizes grants to reimburse municipalities 20 percent of eligible capital costs to encourage and assist in closing unlined solid waste landfills and certain municipal incinerators.

Trends. Chapter 346:86, Laws of 2019 provides that no state aid grants shall be made for any projects under RSA 486, 486-A, or RSA 149-M that have not achieved substantial completion by December 31, 2019. (Chart G)

Flood Control. RSA 122:4 provides flood control reimbursement to those municipalities in interstate flood control compacts. Under the compacts, municipalities receive a payment in lieu of taxes (PILOT) for taxable land that was taken to help mitigate downstream flooding from both the Merrimack and Connecticut rivers. Up until 2012, the state reimbursed the full amount of the PILOT, even if the other states in the compacts (Massachusetts and Connecticut) did not make their payments under the compact terms. In 2012 and 2013, the state only paid its share (approximately 30%) of the PILOT when the other states did not make payments. However, in 2014 funding of $542,672 was provided to compensate municipalities for the PILOT shortfall in 2012 and was paid to municipalities in 2015. Similarly, $163,285 was appropriated in 2016 to partially compensate for the 2013 shortfall. Full funding of the PILOT was made from 2014 to 2019, and the state budget for 2020 and 2021 also included full PILOT funding, regardless of payments from other states.

NH Drinking Water and Groundwater Trust Fund. Established in 2016, RSA 6-D, to provide for the protection, preservation and enhancement of the drinking water and groundwater resources of the state, this trust was initially funded with $276 million from a 2016 lawsuit against Exxon-Mobil involving the gasoline additive MtBE. Authorized expenditures from the trust include competitive cost-sharing grants and low interest loans to municipalities and municipally-owned water utilities, with administration of the trust fund vested in an 18-member commission comprised of state and local officials, as well as business and public members.

The NH Drinking Water and Groundwater Trust Fund Commission reports it has awarded $112 million in grants and loans for the period 2017-2019. Since a significant portion of these awards were for low interest loans that will be paid back into the trust fund over time, it is planned that trust fund assets will be available to fund similar projects for at least the next two decades.

New Hampshire Retirement System

History. The New Hampshire Retirement System (NHRS) was established in 1967 to consolidate and replace four separate pension plan systems: the New Hampshire Teachers Retirement System, the New Hampshire State Employees Retirement System, the New Hampshire Policemen’s Retirement System, and the New Hampshire Permanent Firemen’s Retirement System. NHRS is a public employee retirement system that administers one cost-sharing, multiple-employer pension plan providing a defined benefit annuity based upon a statutory formula, disability, and survivor benefits, for all full-time state employees, public school teachers and administration, permanent police officers, and permanent firefighters. Full-time employees of political subdivisions (such as county, municipal or school district employees) are also eligible to become members of the NHRS if the local governing body elects to participate, which most have. NHRS also administers cost-sharing multiple-employer healthcare plans, known as Other Post-Employment Benefit (OPEB) plans, which provide a medical insurance subsidy to qualified retired members. As of June 30, 2019, there were 48,288 active members of the NHRS and 38,352 retired members (including beneficiaries).

Trends. Funding for the NHRS comes from three sources: investment earnings, employee contributions, and employer contributions. Investment earnings fluctuate from year to year, with annual returns in the past 20 years reaching as high as 23% and as low as -18%. Over the long term, investment earnings provide anywhere from two thirds to three quarters of the funds needed to pay for pension benefits. For projection purposes, an “assumed rate” of investment return is adopted by the NHRS Board of Trustees. This assumed rate had been as high as 9.5% but was gradually lowered to the current rate of 6.75% for use in projecting future investment earnings. Lowering the assumed rate of future investment earnings results in higher employer contributions as explained below.

Employee and Employer Contribution Rates. The employee contribution rates are set by statute and are currently 7% for employees and teachers (Group I), and 11.55% for police and 11.8% for firefighters (Group II) effective July 1, 2011.

Employer rates are adjusted every two years based upon an actuarial valuation to ensure adequate funding for future pension liabilities. Through these biennial rate adjustments, employers not only contribute toward their current employees’ retirement, but also bear the full financial burden of any funding shortfalls in the system, whether those shortfalls are the result of poor investment returns, insufficient funding in the past, losses from actuarial assumptions regarding member demographics (such as when employees will retire, their age at retirement, how long they will live after retirement, and their earnable compensation), or increases in liabilities from statutory changes to the plan design. As previously mentioned, lowering the assumed rate of future investment returns has a direct impact on future employer rates, since it is the employer rates that fluctuate biennially to ensure the system is adequately funded.

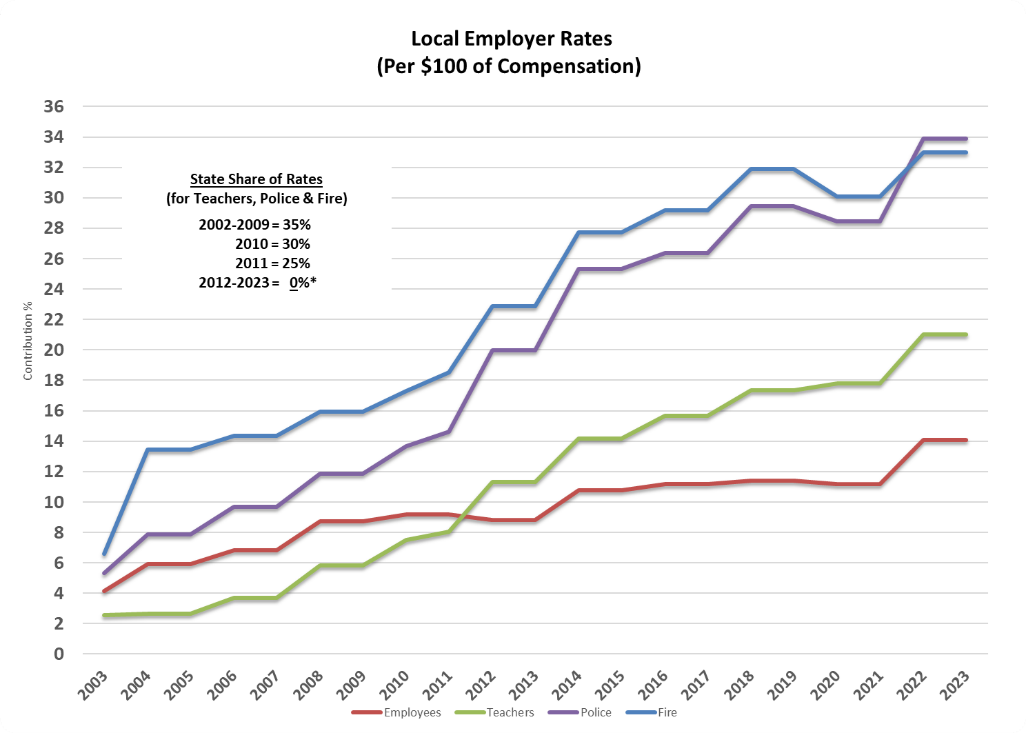

State Contribution for Teachers, Police and Firefighters. The State of New Hampshire had funded a portion of the normal retirement costs for teachers, police and firefighters, a practice that dated back to 1940 under the predecessor retirement systems. Since 1977, the state contribution had been set by statute at 35% of the cost, with municipalities, counties and school districts paying 65% of the cost for teachers, police, and firefighters. (Municipalities, counties, and schools paid 100% of the cost for all other employees enrolled in the NHRS.)

The state contribution rate was lowered to 30% in 2010, to 25% in 2011, to $3.5 million in 2012 and then eliminated in 2013. This resulted in local governments paying 100% of the retirement costs for teachers, police, and firefighters in 2013 and beyond. Chart H illustrates the local government employer contribution rates for every $100 of compensation from 2002 through 2023. The significant increases in the rates from 2010 to 2015 are primarily the result of elimination of the state contribution, reductions in the assumed rate of return, and investment losses from the 2008- 2009 recession.

On July 1, 2021, employer contribution rates for fiscal years 2022-23 will increase an aggregate 19.6% over the 2020-21 fiscal year biennium. The NHRS Board of Trustees certified these rates on September 8, 2020, and noted the most significant drivers of this rate increase, in order of impact, were: 1) the reduction of the assumed rate of return from 7.25% to 6.75%; 2) the adoption of post-retirement mortality assumptions; and 3) a reduction in the payroll growth factor.

As the Governor and Legislature begins creating the state budget for the fiscal year 2022-2023 biennium, municipal officials are urged to talk with their respective Representatives and Senators about the importance of funding these state aid programs and the impact it has had on municipal operations and local property taxes.

Becky I. Benvenuti is the Government Finance Advisor for the New Hampshire Municipal Association. She can be reached by telephone at 603.230.3308 or by email at bbenvenuti@nhmunicipal.org.